How Much Does Paychex Payroll Service Cost?

Last Updated: June 04, 2023

Fact Checked By: Ashley Smith

On This Page

CostOwl.com note: Need a payroll service at an affordable price? Fill out the 30 second questionnaire below and our payroll partners will send you free price quotes.

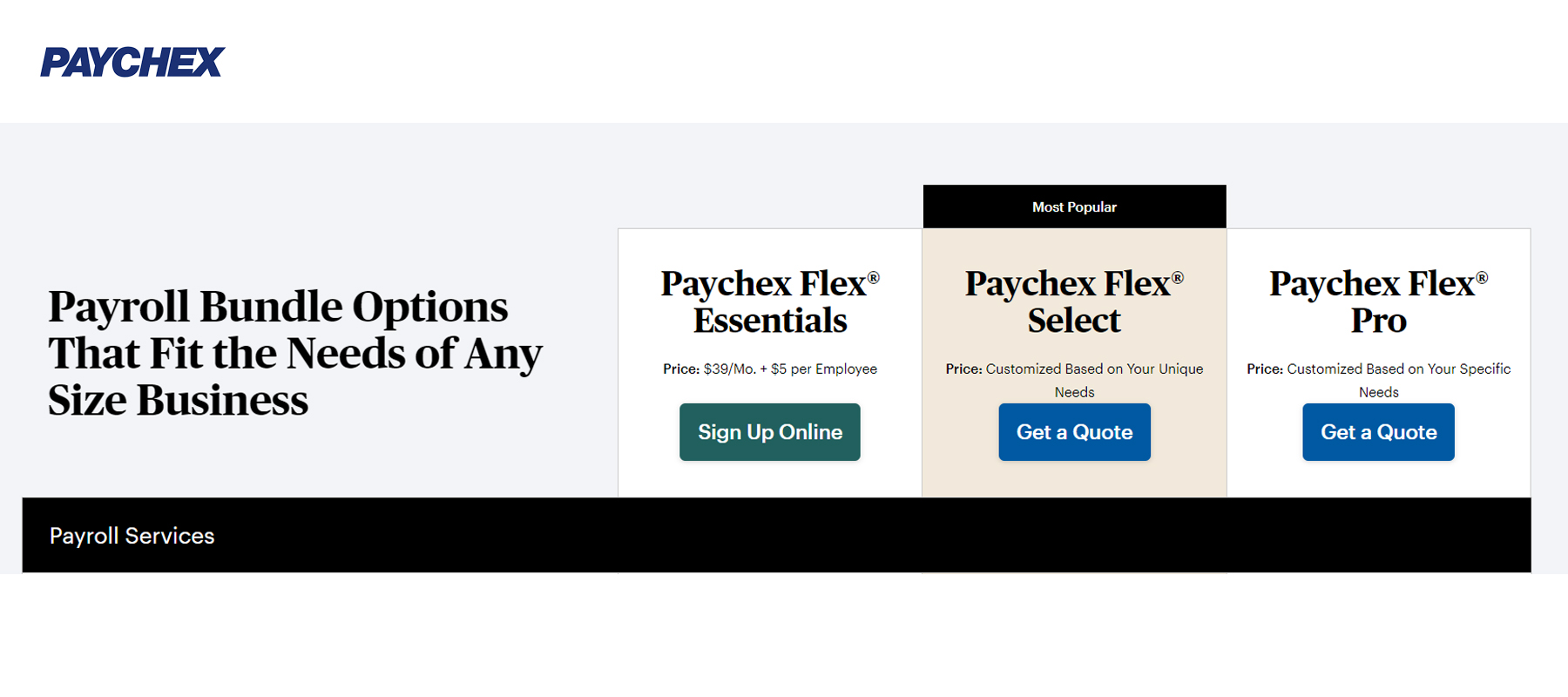

Summary: Paychex Payroll Pricing #

Paychex charges $39 per month and $5 per employee for their Paychex Go package. Paxchex offers Flex and Flex Enterprise packages for companies with 50+ employees with pricing based on each companies needs.

About Paychex Payroll #

Paychex, Inc. was founded in 1971 with a budget of only a few thousand dollars. Since that time, it has become an industry-leading provider of payroll processing services and human resource products. Today, they serve more than a 700,000 businesses across the United States!

Paychex offers outsourcing of everything from basic payroll service to more comprehensive human resource solutions. They have a solution for businesses of all sizes, and everything the company does is backed by its thoroughly trained payroll specialists. No matter how large or how small the needs of clients, Paychex helps them "do what they do best—run their business."

What's included with Paychex Payroll Services #

Paychex offers individual and all-in-one payroll outsourcing services for small and large businesses. A business with fewer than 50 employees can take advantage of the following services:

- Payroll: Paychex offers a number of ways to manage your payroll, including submission via phone, fax, or online payroll services. Plus, each pay period you'll receive comprehensive reports that will help you manage your business.

- Tax Services: Make paying your local, state, and federal taxes easier and more cost-effective by allowing Paychex to handle your tax obligations.

- 401 (k) and Employee Benefits: A good benefits package can help you retain the best employees, especially in a down economy. Paychex offers a number of plans that can help you set up and manage retirement and health plans for your employees that will keep them happy and lower your tax bill. Paychex even offers group health insurance plans that cover medical, dental, vision, life, and more.

- HR Administration and Compliance: Keeping up with state and federal human resource requirements can practically be a full time job. Free up your time for more important tasks by allowing Paychex to hand your employee management services, workers' compensation, COBRA administration, state unemployment insurance, and hew hire reporting.

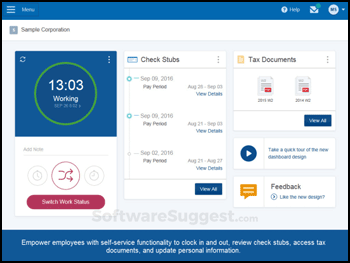

- Time and Labor Solutions: Using the Paychex Time Clock or the company's Time and Labor Online tool, you can more efficiently manage your employees' hours.

If your business has more than 50 employees you can take advantage of Paychex One-Source Solutions, which provide fully scalable centralized management of time and attendance, benefits administration, payroll and tax administration, and much more.

Paychex Payroll Average Cost Samples #

The actual price you pay for outsourcing payroll depends on the number of employees you have and the specific services you require. The prices below, however, should give you a better understanding of average Paychex payroll services cost.

On average, a company with 10 employees will pay approximately $3,300 per year for bi-weekly payroll through Paychex. They also charge a setup fee of $200. Paychex charges an additional fee of $60 plus $6.25 per employee for year-end W-2s and 1099s. Paychex frequently offers discounts on their service of up to 50%.

- One business owner from Oregon with 30 employees reports paying approximately $1,000-$1,500 per month for payroll, employee benefits, and tax services.

- An online reviewer found that a company with 5 employees paid bi-weekly could expect to pay $40-$50 per payroll, or around $80-$100 per month. The same reviewer reported that Paychex charges $15 per payroll for direct deposit payments and around $40 upfront in addition to $2.50 per employee for end of year W-2 processing.

- One small business owner with 4 employees paid approximately $30-$40 per check, which included payroll, direct deposit, and calculating and filing all applicable state and federal taxes.

- A 2011 price comparison between major companies for the cost to prepare payroll and file/pay taxes for a fictitious Virginia business with 10 employees paid weekly (52 pay periods per year) found that Paychex costs around $2,000-$4,000 per year.

Resources: