Medical Billing Service Pricing: Costs, Models, and Rules Explained

Last Updated: September 20, 2023

Reviewed By: Alan Walker, CEO at Medical Billing Services LLC

On This Page

CostOwl.com note: Need a medical software solution at an affordable price? Fill out the 30 second questionnaire below and our medical software partners will send you free price quotes.

Summary: Cost of Medical Billing Services #

In general, a business can expect to pay percentage based charges that range from 3% to 7% of collection per claim for third party medical billing services. Monthly admistrative fees range from $200 to $800 per provider for small practices.

These prices will vary based on whether you use a cloud hosted Software as a Service (SaaS) provider or an on-site solution.

What is Outsourced Medical Billing? #

Running a business requires much more than expertise in the service that you are providing. For example, it takes one set of skills to be a medical practitioner, but running a successful medical practice is a different challenge entirely which requires different talent. Outside of the medical practitioners themselves, the second most important aspect for any practice’s success is finance and billing. Without proper billing and payment management, medical practices will find it hard to be financially sustainable.

Because medical billing is a complex task requiring significant attention to detail, there are many third party vendors on the market who can provide billing expertise and management services. This frees up the leaders and managers of a medical practice to focus on what matters most to them—providing quality care.

Outsourced medical billing services are a great, affordable way to ensure that payments are conducted correctly with transparency to both the managers and the customers.

How Much Does a Medical Billing Company Charge? #

For most medical billing services, there is a mix of up front, one time costs and monthly fees. These up front costs can cover training, set up, administration, licensing, and more while the monthly fees can be for the software subscription, minimum monthly charges for use, or per collection charges that are done at a flat cost or percentage basis.

Medical billing companies typically charge fees based on:

Percentage of collections fee: Ranges from 3% to 7% of the amount collected. This is a common model.

Per claim fee: Some companies charge a flat rate per claim submitted/processed, such as $2-4 per claim.

Monthly subscription: Fees for bundled services start around $200-300 per provider per month. Higher for additional services.

Hourly rate: Some bill hourly for time spent processing claims, at rates from $30-60 per hour.

Value-based pricing: A few bill based on value provided rather than simple volume. May involve benchmarks.

One-time setup fees: Setup fees help cover onboarding costs and can range from a few hundred to over a thousand dollars.

Minimum monthly fees: Even with percentage billing, some companies charge a minimum monthly fee to ensure a revenue baseline.

The pricing model that works best depends on your medical practice's billing volume, revenue, and needs. But most established medical billing services charge within the range of 3-7% of collections or monthly subscription fees between $200-400.

Here are some general ranges of example prices that medical practices might pay for medical billing services.

| Practice Size | Monthly Fee | Percentage of Collections |

|---|---|---|

| Small Practice (1-3 Providers) | $200 - $800 per provider | 4% - 8% of total revenue collected |

| Medium Practice (4-10 Providers) | $800 - $2,500 per provider | 3% - 6% of total revenue collected |

| Large Practice (11+ Providers) | $2,500 - $5,000+ per provider | 2% - 5% of total revenue collected |

Top Medical Billing Services Pricing for 2023 #

Some common SaaS solutions and their rates are listed below. Because the costs of on-site solutions vary based on the specific needs of the client, contact the on-site provider for a tailored quote based on your organization’s requirements.:

| Medical Billing Service | Pricing |

|---|---|

| ADP AdvanceMD | 4% to 8% collections rate or $1.42 per claim |

| NueMD | Bundled billing and EHR services from $149 to $249 per month |

| Capture Billing | 7.9% to 10.9% with a one-time start-up fee of $1,297 and monthly minimum fee of $999 |

| Kareo | Starts at $150 per provider |

| Medical Billing Star | 5% to 7% per claim with an option to do solely coding for $0.99 per claim |

| MTBC | Monthly subscription fees starting at around $200 per provider |

| ClaimCare | 5-7% of collected revenue |

| Ability Network | Plans starting at $449/month for up to 50 claims |

| CareCloud | Plans starting at $179/month for basic services |

| DrChrono | Plans starting at $199/month |

| Athenahealth | 3-5% of collections |

| eClinicalWorks | Around 5% of collections, plans from $350/month |

| AdvancedMD | Plans starting at $359/month |

Here is the markdown with the monthly price amounts bolded:

Example Medical Billing Service Costs #

Small Family Practice

- 1 doctor, ~1,500 patients

- $2,000 per month

- Full revenue cycle management

Cardiologist Practice

- 2 doctors, ~3,000 patients

- $3,500 per month

- Software, reporting, revenue cycle management

Mid-sized Orthopedic Clinic

- 4 doctors, ~10,000 patients

- $6,000 per month

- Dedicated account reps, insurance verification, resubmission

Large Multi-specialty Practice

- 10 doctors, 25,000 patients

- $12,000 per month

- Coding, claim scrubs, follow-up, denial management, analytics

Small Surgery Center

- ~300 procedures per month

- $1,500 per month

- Complete claim submission and reimbursement services

Other Cost Considerations #

When shopping for a billing service provider, it is important to keep some things in mind.

1. Beware Excessively Low Costs

If a service provides a cost that is exceedingly lower than competitors, or is even a free to use platform, be aware that the quality of these services may not be up to the standards you require. These services may be performed by unqualified staff who are not as thorough as more robust and established providers. Whoever you hire as your billing service, remember that you are entrusting them with your finances—a key component of your business that will make or break your organization.

2. Avoid Excessive Fees

While some fees such as administration, training, and set up are common, avoid businesses that have an excessive amount of other charges such as clearinghouse fees, patient statement fees, or customer support fees. Always check with your prospective provider and ask for a quote on what the total cost would be while asking them to explain each and every charge.

3. Pay Attention to Monthly Minimums

While monthly minimum charges are common, be sure that your organization can afford to pay those rates regularly. This is especially important if you are a small firm or just starting out. Make sure your revenue is high enough to meet the minimum monthly fees while still being profitable.

Why Hiring a Medical Billing Service Makes Sense #

Outsourcing your medical billing can provide several advantages that positively impact your practice's operations and financial performance. Consider these benefits:

Increased Collections

- Billing services are extremely effective at optimizing reimbursement by correctly submitting and following up on claims, appealing improper denials, and staying current with payer policy changes. This expertise typically translates into significantly higher collection rates. AMA study found practices using billing services saw 11-26% higher collection rates.

Fewer Denied Claims

- Experienced billers understand payer requirements and will catch errors before submitting claims, sparing your practice costly denials down the road. They persistently investigate and appeal any erroneous denials. An estimated 30-40% of claims have errors resulting in initial denial.

Faster Reimbursement

- A knowledgeable billing staff adeptly handles claim submissions and follows up on outstanding claims to accelerate payments. This improves practice cash flow. Outsourced billers can reduce payment turnaround by 7-15 days on average.

More Time for Patients

- Outsourcing billing and collections liberates doctors and staff to devote their energy fully to delivering excellent patient care rather than administrative duties. One study found outsourcing reduced time spent on billing by 24%.

Regulatory Compliance

- Reputable billing companies are well-versed in continually evolving coding, billing, and quality reporting regulations. They ensure your practice avoids penalties and audits. Billing companies maintain 97-99% claim acceptance rates.

Specialized Technology and Personnel

- Billing firms leverage industry-leading software and employ certified medical billing specialists. Your practice benefits from their expertise cost-effectively. 75% of in-house billers lack formal training.

While outsourcing does require an investment, most practices find that it pays for itself many times over through optimized collections, reduced denials, accelerated payments, and time savings. The pros at billing services have the skills to handle these specialized administrative tasks efficiently.

SaaS Medical Billing Compared to On-Site #

One major factor determining the cost of a medical billing service is whether you use a cloud based SaaS platform or a more comprehensive, on-site solution. Depending on the type of organization you run, one type of billing solution may be more effective than the other.

1. SaaS Medical Billing

In the growing age of technological connectivity, SaaS platforms are becoming more commonplace across a range of business services. For example, many SaaS companies provide Electronic Medical Record (EMR) services in addition to billing, payroll, and other medical management functions all in one bundled software package.

With an SaaS solution, the medical practitioner pays a monthly fee in order to access the online program. This fee is usually based on a “per user” model with varying rates depending on the size of your office. With SaaS solutions, there is little to no hardware installed on-site and the interface typically requires minimal training for employees to operate and input the required data. The complex work, filing, and billing is done by the software program or a remote member of the third party service, so minimal training is required for use by in-house staff.

SaaS solutions are a cost effective way for small to medium sized organizations to outsource billing services because the client is paying an affordable per month rate as opposed to high upfront costs that come with other methods of third party outsourcing. However, these platforms tend to have limits in what services they can provide and how well they can tailor to your business’ specific needs. For these reasons, extremely large, enterprise level firms may opt of an on-site billing service solution.

2. On-Site Medical Billing

Unlike SaaS platforms, on-site solutions bring the billing services to your office. This can involve installation of servers and equipment as well as training for employees and your IT department for use and maintenance. On-site billing platforms typically charge high up front fees for licensing, installation, and training with low monthly fees for backend support.

While on-site platforms are more expensive than SaaS solutions, they can often be more robust and specifically tailored to your organization’s exact needs.

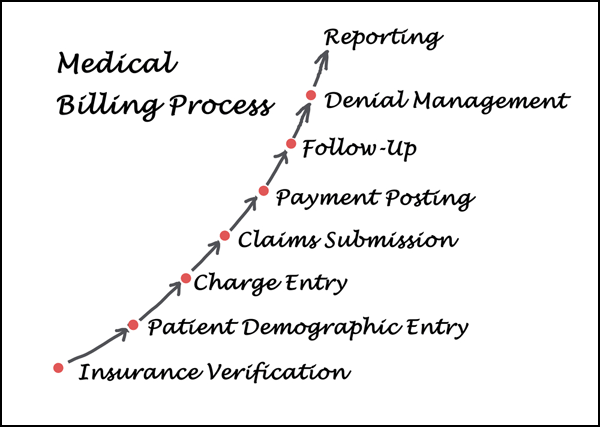

Steps Medical Billing Companies Use to Collect Debts #

Send billing statements. They will send regular billing statements and reminders for the amount owed.

Make phone calls. If bills remain unpaid after statements are sent, they will call the patient directly to follow up and try to collect payment.

Send debt collection letters. More formal letters demanding payment may be sent warning of further action if payment is not received.

Report to credit bureaus. Unpaid debts may be reported to credit bureaus like Equifax, Experian, etc. which damages the patient's credit score.

Hire debt collection agency. If internal efforts are unsuccessful, the unpaid account may be assigned to a debt collection agency which will pursue payment.

Legal action. Debt collection lawsuits may be filed against the patient to obtain a court judgement mandating payment. Wage garnishments or liens may then follow.

Send to bad debt recovery. As a last resort, severely delinquent accounts considered uncollectible may be sent to a bad debt recovery service to try to salvage some payment.

Write off debt. If all collection efforts fail, the medical debt may be written off as a loss by the billing company for tax purposes. The debt still legally remains owed by the patient.

The specific actions taken will depend on the billing company and size of the debt. But these are typical steps used in attempting to secure payment on overdue medical bills.

Rules for Medical Billing Companies #

Compliance with HIPAA privacy and security regulations for protected health information

Using valid medical codes (CPT, ICD-10, etc) and documenting medical necessity

Avoiding fraudulent/abusive billing practices like upcoding or billing for unperformed services

Submitting claims within timely filing deadlines for each payer

Providing accurate patient and provider information on claims

Maintaining proper billing records, documentation, and audit trails

Disclosing required financial interests, ownership, and control information

Not waiving patient copays/deductibles or providing free services as inducements

Avoiding activities that could be seen as paying for patient referrals (anti-kickback laws)

Following Medicare/Medicaid regulations if billing government payers

Allowing access to records for audits by payers or regulators

Using proper billing appeal and grievance processes

Maintaining appropriate licensing in all states where patients are served

The focus is on accurate, compliant billing and protecting patient privacy above maximizing revenues. Unethical practices can lead to steep penalties.

Conclusion #

When utilized correctly, medical billing services can provide a huge boost to a medical practice’s efficiency and bottom line while freeing up medical professionals to focus on other aspects of patient care. These vendors provide comprehensive, professional, billing expertise that would otherwise be extremely expensive to produce internally. Compare medical billing service rates today with our free tool to get started!

Resources:

- 7 Benefits of Using Medical Billing Services

- Medical Billing Contracts: Everything You Need to Know

- Medical Billing Rates & Fees